PRESS RELEASE

Mobile phone insurance policies can innovate by adding cyber protection

Download the PDF version of this press release here

London, 30 August 2021 – Across the world, people depend more and more on their mobile phones at the same time that the threat of cyber attack is increasing. These two trends are on a collision course, but most consumers remain unprotected from the risk of malware attacks or fraudulent use of their phones because mobile phone protection is usually limited to the sort of cover offered by extended warranties.

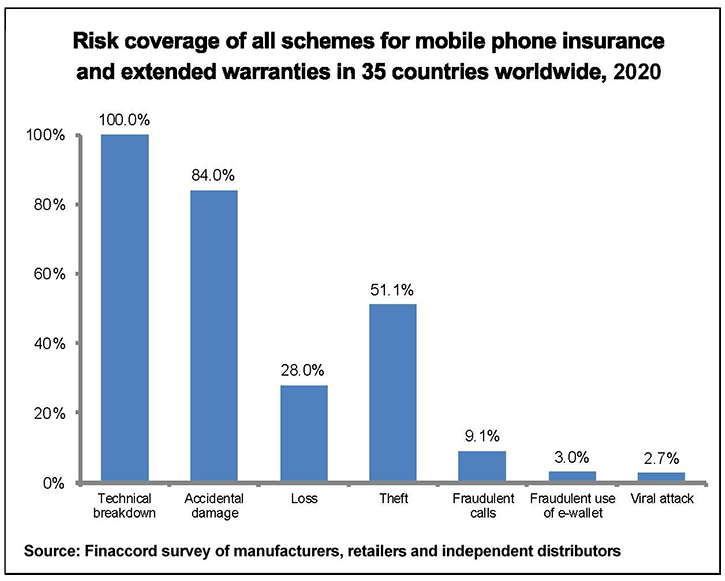

This is one of the findings from a series of reports published by Finaccord on mobile phone insurance and extended warranties covering 35 countries globally. It identified 1,052 policies for mobile phones and analysed their risk coverage split between cover against technical breakdown, accidental damage, loss, fraudulent calls, fraudulent use of an e-wallet and viral attack.

There were just six out of these 35 countries where 10% or more of policies offered protection against at least one of fraudulent calls, fraudulent use of an e-wallet and viral attack. Cover for viral attack was available in just 28 out of these 1,052 policies, or 3% of the total, and many of these cases were concentrated in India and Poland, where 21% and 23% of policies included this form of protection. Cover against fraudulent calls or fraudulent use of an e-wallet was most common in the UK (34% and 17% of policies respectively), while at least one of these risks was covered by between 10% and 20% of policies in Australia, Italy, Russia, South Africa and Spain.

Aside from offering greater protection to consumers against emerging cyber threats, policies offering this type of cover benefit insurance providers by turning an extended warranty with a fixed lifespan of a couple of years into a policy that can be renewed indefinitely.

The report also lists which companies underwrite mobile phone insurance and extended warranty policies. Assurant and Allianz have the greatest number of these partnerships, but when weighted by their importance of their distributors, Finaccord found that Asurion took first place ahead of Assurant.

In addition, the report estimates the total value of this market worldwide and by country, in terms of revenues and number of policies, from a global base of 5.6 billion mobile phone subscribers. Enzo Guzzi, author of the report, commented that “the market for mobile phone insurance and extended warranties has grown constantly in recent years, fuelled by the spread of smartphones and the increasing cost of handsets. Now that many mobile phone markets are effectively saturated, providers need to increase the take-up rate for cover through new distribution partnerships and product innovation in order to maintain recent growth rates.”

--- ENDS ---

Media contact: David Parry, +44 20 7086 0287,

[email protected]

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services that is part of Aon Global Operations SE Singapore Branch, a part of Aon plc (NYSE: AON). It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances, as well as commercial lines insurance.

Finaccord has published a series of reports about the market size, distribution and forecast for mobile phone insurance and extended warranties in 35 countries, both as an overview report (

Global Mobile Phone Insurance and Extended Warranties: A Worldwide Review 2020) and as regional titles for the Americas, Asia-Pacific and Europe.

These reports estimate the market size for mobile phone insurance and extended warranties in each country. They cover close to 2,170 organisations involved in the production and distribution of mobile phones and logged 1,052 schemes for mobile phone insurance and extended warranties offered by manufacturers, retailers and independent providers, together with the identity of the provider for each of these schemes. This enables the reports to show which insurers are most active in each country.

They also analysed which risks were covered by these policies across seven categories, and the results of this are shown in the following chart.